The Supermarket Cartel: Who Controls What You Eat

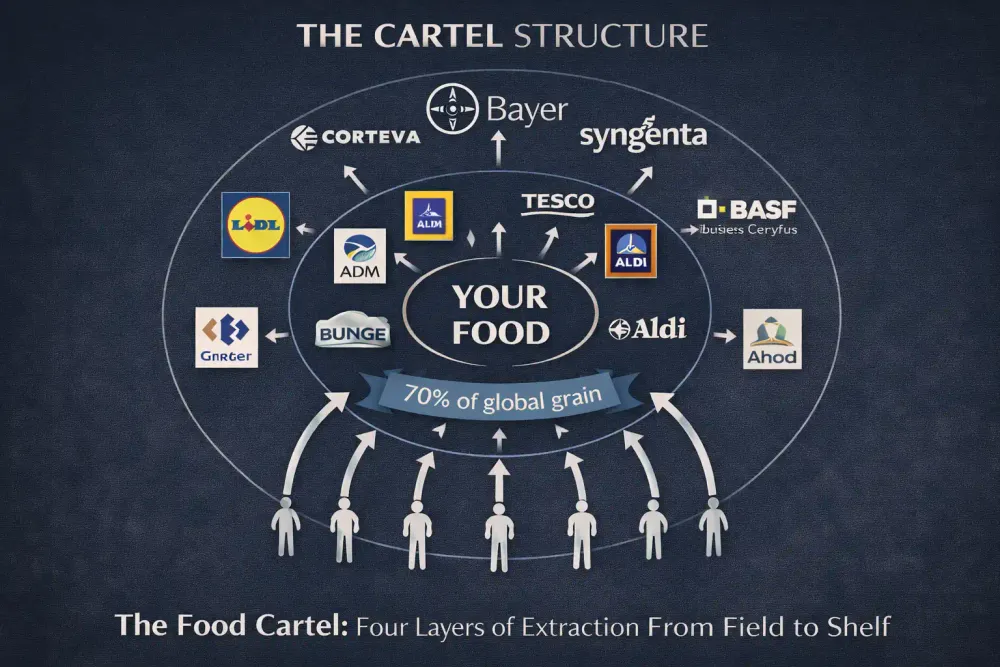

Four commodity trading companies (Cargill, ADM, Bunge, Louis Dreyfus) control 70%+ of global grain trade setting prices globally, owning storage and transport chokepoints, speculating on food during crisis profiting 65-86% during 2008 famine while people starved.

Your tomatoes come from Morocco while Spanish farms die.

Your chicken comes from Brazil while French farmers go bankrupt.

Your wheat comes from Ukraine while German fields sit empty.

Four companies control 70% of global grain trade, Cargill, ADM, Bunge, Louis Dreyfus.

Five supermarket chains control what appears on European shelves, Carrefour, Tesco, Schwarz Group, Aldi, Ahold Delhaize.

Farmers get 12-18% of retail food price. Supermarkets and middlemen take the rest.

French farmer suicides: 1 every 2 days. Debt, bankruptcy, despair.

European food sovereignty destroyed. Import dependency created. Corporate control absolute.

This is how they colonized your dinner plate.

Introduction

Walk into any European supermarket. The shelves are full. Produce looks abundant. Prices seem reasonable. Everything appears normal.

Now look closer at where the food actually comes from.

Tomatoes: Morocco, Turkey. Apples: Chile, New Zealand. Chicken: Brazil, Thailand. Beef: Argentina, Brazil. Wheat: Ukraine, Canada. Oranges: South Africa, Egypt. Green beans: Kenya, Morocco.

Wait a fucking minute.

Europe produces tomatoes. Spain and Italy have perfect climate and centuries of tomato-growing tradition. Yet supermarkets sell Moroccan tomatoes while Spanish farms go bankrupt and fields are abandoned.

Europe produces chicken. France has world-class poultry farming. Yet supermarkets import Brazilian chicken while French farmers can't make a living and commit suicide at a rate of one every two days.

Europe produces wheat. France and Germany are agricultural powerhouses. Yet supermarkets stock Ukrainian and Canadian wheat while European farmers dump grain because prices are below production cost.

This isn't about exotic foods. This isn't specialty items or tropical fruit. This is basic food, tomatoes, chicken, wheat, apples, dairy, coming from thousands of miles away while local farms that could produce it die.

Why?

Because a cartel controls European food from field to shelf. Commodity traders control what moves. Supermarkets control what sells. Agribusiness giants control what grows. And farmers, the people who actually produce food, have become the most exploited link in a chain designed to extract maximum profit while destroying food sovereignty, rural communities, and any alternative to corporate control.

This investigation exposes how four commodity trading companies control 70% of global grain trade setting prices and controlling flows. How five supermarket chains dominate European retail demanding prices below production cost and favoring imports over local food. How agribusiness giants patent seeds and chemicals forcing farmer dependency. How EU agricultural policy with its €387 billion budget subsidizes large industrial farms while burying small farmers in bureaucracy. How investment funds buy agricultural land treating food production as asset class for rent extraction. How this system creates import dependency destroying food security and giving foreign suppliers political leverage. How farmer suicides reached epidemic levels across France, Ireland, Netherlands, Germany as generations of farming end in bankruptcy and despair. How supermarkets extract 50-70% margin while farmers get 12-18% of retail price. How quality declined as food is produced for transport not taste, picked unripe, gassed to ripen, chosen for shelf-life over nutrition. How farmer protests across Europe, France's tractor blockades, Netherlands' nitrogen regulation uprising, Poland blocking Ukrainian imports, are suppressed and dismissed while the destruction accelerates.

The evidence is in commodity market data, supermarket financial reports, farmer bankruptcy statistics, EU agricultural spending records, suicide rates, import/export flows, and the testimonies of farmers watching their way of life systematically destroyed.

The conclusion is unavoidable: your food is controlled by a cartel. They decide what you eat, where it comes from, what it costs, and who profits. Farmers are being eliminated. Food sovereignty is being destroyed. And you're paying more for worse food while corporations extract billions.

By A. Kade

What This Investigation Exposes

The commodity trader cartel controlling global food flows through Cargill, ADM, Bunge, Louis Dreyfus who handle 70%+ of world grain trade, set prices globally, own storage and transport chokepoints, speculate on food driving price spikes, and operate with zero transparency as private companies. The supermarket oligopoly dominating European retail through five chains controlling 60%+ market share, demanding prices below farmer production cost, extracting 50-70% margin while farmers get 12-18%, favoring imports with higher margins over local food, and using vertical integration to own supply chains. The agribusiness seed and chemical monopoly where Bayer-Monsanto, Corteva, Syngenta, BASF control seeds through patents preventing farmer seed-saving, force annual chemical purchases through engineered dependency, and create debt traps for farmers globally. EU Common Agricultural Policy failure with €387 billion annual budget favoring mega-farms through subsidy distribution, burying small farms in bureaucratic compliance costs, implementing environmental regulations impossible for family farms, and encouraging consolidation replacing family farms with corporate agriculture. The import dependency trap where Europe imports basic food it can produce locally creating food security vulnerability proven by Ukraine war grain crisis, giving foreign suppliers political leverage like Morocco and Turkey, and destroying local production capacity permanently. The farmer suicide epidemic with French farmers dying at rate of one every two days from debt and bankruptcy, Netherlands farmers facing land seizures under nitrogen regulations, German dairy farmers dumping milk as prices fall below costs, Irish and UK farmer mental health crisis, and generational farming knowledge lost as young people flee. The supermarket extraction mechanism where farmers receive 12-18% of retail price for produce, supermarkets extract 50-70% margin on fresh food, commodity traders take cut on grain and bulk commodities, processors and distributors extract additional layers, and consumers pay high prices for imports while farmers go bankrupt. The quality decline through industrial agriculture optimizing for yield not nutrition, long-distance transport requiring early harvest and chemical ripening, variety selection for shelf-life and appearance not taste, and pesticide-heavy monoculture depleting soil and killing pollinators. The land grab by investment funds where BlackRock and pension funds buy agricultural land as asset class, farmland becomes rent-extraction vehicle not food production, corporate mega-farms replace family operations, and rural communities die as farming industrializes. The farmer protest suppression across France with tractor blockades against unfair competition, Netherlands uprising against farm closures, Poland blocking Ukrainian grain imports protecting local farmers, Germany protesting fuel subsidy cuts, Spain fighting Moroccan imports, all dismissed as backwards resistance to progress. The food security destruction where Europe cannot feed itself anymore, Ukraine war exposed grain import dependency, political leverage created for Morocco Turkey and others, supply chain disruption risks catastrophic, and sovereignty traded for corporate profit. And why local food costs more than imports despite logic through subsidy arbitrage where foreign farms subsidized, regulatory arbitrage with lower standards abroad, labor exploitation in developing countries, and corporate preference for imports with higher margins.

The truth doesn’t trend. It survives because a few still care enough to keep it alive.

Keep The Kade Frequency transmitting.

The Commodity Trader Cartel: Four Companies Control Your Food

Global grain trade, wheat, corn, soybeans, the basics of human and animal food, is controlled by four companies. Not dozens of competitors. Not a free market. Four companies handling 70%+ of worldwide trade.

The ABCD Companies:

Cargill (United States, family-owned, largest)

Archer Daniels Midland - ADM (United States, publicly traded)

Bunge (United States, publicly traded)

Louis Dreyfus (Netherlands/France, family-owned)

These aren't household names. You've never seen their brands on supermarket shelves. They operate in the shadows between farmers and consumers. But they control what moves, where it goes, and what price farmers receive.

How They Control:

According to Oxfam research on food commodity traders, the ABCD companies dominate through ownership of critical infrastructure:

Storage facilities across major producing regions. Farmers must sell grain for storage, these companies own the silos. Can't store it yourself? You sell at their price or watch it rot.

Transportation networks including port facilities, rail access, shipping capacity. Grain doesn't move without going through their logistics. They control the bottlenecks.

Processing capacity for turning raw commodities into food ingredients. Flour mills, soybean crushing, corn processing. Farmers sell raw crops, consumers buy processed food, these companies own the transformation.

Trading desks with global market information. They see supply and demand across continents in real-time. Farmers see local conditions. Information asymmetry = power asymmetry.

The Price-Setting Mechanism:

Farmers are price-takers, not price-makers. When French wheat farmer harvests crop, he calls local grain elevator (likely owned by one of ABCD). They offer a price based on "global market conditions." Take it or leave it.

The farmer has no alternative buyer. Can't store grain indefinitely. Can't transport it himself. Must sell.

The price offered is determined by commodity futures markets in Chicago and London where ABCD companies are major traders. According to research by IPES-Food, these companies can influence prices through:

Position-taking in futures markets. When you control 70% of physical grain movement, your futures positions move markets. Speculation becomes self-fulfilling.

Information advantage. Knowing global supply (they move it) and demand (they sell it) lets them trade ahead of market adjustments. Legal insider trading.

Storage timing. Hold grain back when prices low (reducing supply artificially), release when prices spike (after positioning in futures). Price manipulation through inventory management.

The 2008 food price crisis, when grain prices doubled causing riots in 30+ countries, coincided with record profits for ABCD companies. Cargill's profits increased 86% that year. ADM up 65%. Bunge up 77%. According to World Development Movement reports, commodity speculation by traders and financial institutions drove prices up while people starved.

The Opacity:

Cargill and Louis Dreyfus are privately held family companies. They publish no financial data. Zero transparency about profits, practices, market positions.

ADM and Bunge are public but commodity trading is consolidated in subsidiaries with minimal disclosure. According to Feedback EU research, even public filings reveal almost nothing about actual trading activities.

This opacity is deliberate. When you control food flows for billions of people, you don't want scrutiny. Cargill has been investigated multiple times for price manipulation, market abuse, environmental destruction. Fines paid. Operations continue.

The Global Reach:

Cargill alone operates in 70 countries with 155,000 employees. Revenue: $165 billion (2023). That's larger than most countries' GDP. For a company most people have never heard of.

These companies don't just trade grain. They control:

- Soybeans (animal feed, vegetable oil)

- Palm oil (in everything processed)

- Sugar

- Cotton

- Cocoa

- Coffee

According to ETC Group monitoring, ABCD companies plus similar trading giants (Wilmar, COFCO, Glencore Agriculture) control majority of global trade in every major agricultural commodity.

Why Farmers Can't Escape:

Individual farmers cannot access global markets directly. Too small. No infrastructure. No market intelligence. No bargaining power.

Cooperatives tried competing but ABCD companies undercut them, bought them out, or outlasted them. According to La Via Campesina farmer movement documentation, farmer cooperatives worldwide have been systematically destroyed by commodity trader dominance.

The ABCD cartel isn't illegal monopoly, it's oligopoly. Four companies aren't one company. But they don't need explicit collusion when they all benefit from the same structure: controlling chokepoints, extracting margin, keeping farmers desperate.

And European farmers selling wheat, corn, rapeseed? They're selling to ABCD subsidiaries whether they know it or not. The price they get was set in Chicago by traders who've never touched soil.

"Give me control of a nation's money supply, and I care not who makes its laws." - Mayer Amschel Rothschild, 1790s

Replace "money supply" with "food supply" and you have the ABCD cartel.

The Supermarket Oligopoly: Five Chains Decide What You Eat

Commodity traders control food movement globally. But in Europe, five supermarket chains control what appears on shelves, what farmers can sell locally, and what prices consumers pay.

The Big Five:

Schwarz Group (Lidl, Kaufland) - Germany, €155 billion revenue

Carrefour - France, €94 billion revenue

Tesco - UK, €75 billion revenue

Aldi - Germany (split into Aldi Nord and Aldi Süd), €72 billion combined

Ahold Delhaize (Albert Heijn, Delhaize) - Netherlands/Belgium, €76 billion revenue

According to Eurostat retail trade statistics, these five groups plus a handful of national chains (Rewe in Germany, E.Leclerc in France, Mercadona in Spain) control approximately 60-70% of European grocery retail depending on country.

In individual countries, concentration is even worse:

- Germany: Top 5 retailers = 85% market share

- France: Top 5 = 75% market share

- UK: Top 4 = 75% market share

- Netherlands: Top 3 = 70% market share

This is oligopoly. Farmers have nowhere else to sell. Consumers have limited alternatives. And supermarkets exploit both.

How They Squeeze Farmers:

Supermarkets demand prices below production cost. Not negotiated fairly, dictated through buyer power.

Example from Copa-Cogeca European farmers union data:

French tomatoes:

- Farmer production cost: €1.20/kg

- Supermarket purchase price: €0.90/kg

- Retail price to consumer: €2.50/kg

Farmer loses €0.30/kg. Supermarket makes €1.60/kg margin (178% markup).

Farmer goes bankrupt. Supermarket profits.

Then supermarket sources tomatoes from Morocco where labor is €2/day instead of French €12/hour minimum wage. Moroccan tomatoes cost supermarket €0.60/kg. Retail price stays €2.50/kg. Now supermarket makes €1.90/kg (317% markup).

French farms close. Land abandoned. Import dependency created. Supermarket profits increase.

The Vertical Integration:

Major supermarkets don't just buy from suppliers, they own suppliers.

Carrefour operates farms in Spain producing vegetables.

Tesco owns dairy processing facilities.

Schwarz Group has direct sourcing from contracted farms in Eastern Europe and North Africa.

According to Institute for Agriculture and Trade Policy analysis, vertical integration lets supermarkets:

Control every margin. Instead of farmers, processors, distributors each taking cut, supermarket takes all cuts by owning supply chain.

Bypass local farmers. When you own production abroad, you don't need to buy from domestic farmers at all.

Set quality standards impossible for small farms. Certification requirements, traceability systems, delivery schedules designed for industrial scale. Small farms can't comply. Convenient excuse to reject local produce.

The Preference for Imports:

Supermarkets actively prefer imports over local food. Why?

Higher margins. Exploited labor abroad is cheaper. Lower standards mean lower costs. Supermarket keeps difference.

Supplier desperation. Moroccan farm has no alternative buyers, must accept supermarket price. French farm might have farmers market option. Desperate suppliers = better terms for supermarkets.

Avoiding farmer power. If supermarkets bought locally, farmers could organize collectively. Spread across countries, farmers can't coordinate. Divide and rule.

According to Transnational Institute research on supermarket supply chains, supermarkets deliberately source from distant suppliers to prevent supplier bargaining power.

The Private Label Takeover:

Walk into Lidl or Aldi. Most products are store brands. Carrefour, Tesco same pattern. Private labels now 40-50% of supermarket sales.

This isn't random, it's strategy. Private labels let supermarkets:

Capture brand margin. Instead of paying Coca-Cola or Danone for their brand, supermarket creates own brand and keeps brand premium.

Control suppliers completely. Private label supplier is entirely dependent on supermarket. Try to negotiate price? Supermarket switches supplier. Zero bargaining power.

Hide sourcing. "Carrefour tomatoes" could come from anywhere. No transparency. Consumer can't boycott based on origin.

According to European Commission grocery retail studies, private label growth correlates with increased supermarket profit margins and declining farmer income.

The Race to Bottom:

Lidl and Aldi business model: ultra-low prices through ultra-low costs. This forces other supermarkets to compete on price. Which forces all supermarkets to squeeze suppliers harder.

German Aldi sells milk for €0.65/liter. Farmers receive €0.35/liter. Production cost: €0.45/liter. Farmers lose €0.10/liter.

But if Rewe charges €0.80/liter for same milk, consumers buy Aldi's. So Rewe must match price. Which means paying farmers even less.

The race to bottom destroys farming. According to German Farmers Association (DBV) reports, German dairy farmers went from 150,000 in 2000 to 55,000 in 2023. Two-thirds gone. Those remaining are larger industrial operations. Family farms couldn't survive.

Why This Is Legal:

EU competition law prohibits monopoly abuse. But five companies isn't monopoly, it's oligopoly. Legal.

France passed "EGalim" law in 2018 requiring supermarkets to pay farmers minimum threshold above production cost. According to French Competition Authority analysis, supermarkets found loopholes:

- Redefine "production cost" downward

- Require additional "services" reducing net payment

- Switch to imports not covered by law

- Lobby for law weakening (successful 2021 amendments)

The law failed. Farmer income didn't rise. Supermarket profits did.

The Alternative They Crush:

Farmers markets, direct sales, community-supported agriculture (CSA) work beautifully. Farmers get fair price. Consumers get quality. No middleman extraction.

Supermarkets hate this. According to Friends of the Earth Europe research, supermarkets lobby against:

- Public procurement prioritizing local food

- Farmers market expansion

- Direct farm-to-consumer platforms

- Food sovereignty policies

They want dependency. Control. Extraction.

And they're winning.

The Agribusiness Seed and Chemical Trap

Commodity traders control food movement. Supermarkets control food sales. But agribusiness giants control what farmers can even grow.

The Seed Monopoly:

Four companies control over 60% of global seed market:

Bayer (acquired Monsanto 2018) - 25% market share

Corteva (DowDuPont agriculture) - 21% market share

Syngenta (ChemChina) - 8% market share

BASF - 6% market share

According to ETC Group monitoring of seed industry, these companies don't just sell seeds, they control genetics through patents, making seed-saving illegal and forcing annual repurchase.

How Patent Control Works:

Traditional farming: Save seeds from harvest, plant next year. Free. Sustainable. Farmer autonomy.

Corporate seed patents: Seeds are intellectual property. Saving seeds = patent infringement. Must buy new seeds every year.

According to research by GRAIN on seed patenting, Monsanto (now Bayer) pioneered aggressive patent enforcement:

Terminator seeds: Genetically modified to be sterile after one generation. Plant won't reproduce. Must buy annually or starve.

Contract enforcement: Farmers sign agreements prohibiting seed-saving. Bayer employs investigators to check farms, sue violators. U.S. farmers paid over $23 million in Monsanto patent infringement settlements 1997-2018.

Contamination lawsuits: GMO pollen drifts to organic neighbor's field. Organic farmer now has patented genetics without consent. Monsanto sued the contaminated farmer for patent infringement. Supreme Court sided with Monsanto (Bowman v. Monsanto, 2013).

This isn't farming. It's subscription agriculture. And it's spreading to Europe despite GMO resistance.

The Chemical Dependency:

The same companies that control seeds control agricultural chemicals, pesticides, herbicides, fungicides, fertilizers.

Bayer: Seeds AND chemicals (glyphosate/Roundup)

Corteva: Seeds AND chemicals

Syngenta: Seeds AND chemicals

BASF: Seeds AND chemicals

They engineer dependency: sell seeds requiring specific chemicals they also sell.

Roundup Ready crops: Genetically modified to tolerate Bayer's glyphosate herbicide (Roundup). Spray entire field with Roundup, kills all plants except patented crop. Sounds convenient.

Except you must buy:

- Roundup Ready seeds (annual license, expensive)

- Roundup herbicide (Bayer brand, expensive)

- Increasing doses as weeds develop resistance

According to U.S. Geological Survey data, glyphosate use increased 15-fold from 1996-2016 as weeds evolved resistance requiring higher application rates.

Farmers trapped: can't use cheaper generic seeds (patented), can't save seeds (illegal), must buy increasing chemical volumes (resistance).

The European Spread:

EU restricts GMO crops more than U.S., but agribusiness found workarounds:

Hybrid seeds: Not GMO but sterile or low-vigor in second generation. Must buy annually.

Chemical dependency without GMO: Conventional seeds bred to respond to specific fertilizer regimes sold by same company.

Patent everything: Even non-GMO plant varieties can be patented under EU law. According to No Patents on Seeds coalition, Bayer, BASF, Syngenta hold thousands of European patents on conventional crops, tomatoes, peppers, melons, broccoli.

Farmers who try saving seeds from patented varieties face lawsuits. The threat alone enforces compliance.

The Debt Trap:

According to research by La Via Campesina on farmer indebtedness, the annual seed and chemical purchase requirement creates debt cycles:

Year 1: Farmer borrows to buy seeds and chemicals

Harvest: Sells to commodity trader at low price

Revenue insufficient to cover debt and next year's inputs

Year 2: Borrows more for seeds, chemicals, AND previous debt

Repeats until bankruptcy

Indian farmer suicides (350,000+ since 1995 according to National Crime Records Bureau) are directly linked to Monsanto Bt cotton debt traps. Farmers bought expensive seeds and chemicals on credit, crops failed or prices collapsed, debt became unpayable, suicide seemed the only escape.

Same pattern emerging in Europe. French, German, Irish farmers increasingly indebted to agribusiness suppliers. According to European Parliament research on farm debt, average EU farm debt increased 40% from 2010-2020 while farm income stagnated or declined.

The Consolidation Goal:

Agribusiness benefits from farm consolidation. Small farms can't afford patented seed systems. Large industrial farms can.

As family farms go bankrupt unable to afford inputs, land gets bought by:

- Larger farms (industrial agriculture)

- Investment funds (rent extraction)

- Agribusiness companies themselves (vertical integration)

According to Transnational Institute research on land concentration, 3% of farms in Europe control 50% of farmland. Mega-farms, corporate operations, investment vehicles.

Family farms declining, corporate control increasing. Exactly as designed.

"He who controls the food supply controls the people." - Henry Kissinger

Agribusiness took this seriously.

The EU Agricultural Policy Failure: €387 Billion Subsidizing Destruction

The EU Common Agricultural Policy (CAP) has a budget of €387 billion for 2021-2027, the largest single item in EU budget at 31% of total spending.

Ostensibly, CAP supports farmers and rural development. Actually, CAP subsidizes industrial agriculture, buries small farms in bureaucracy, and accelerates consolidation.

Where The Money Goes:

According to European Commission CAP spending data, CAP payments are distributed based primarily on land area.

The more land you farm, the more subsidy you receive.

Result: 80% of CAP subsidies go to 20% of farms, the largest ones.

According to Greenpeace analysis of CAP data, in 2020:

- Top 1% of farms received 12% of total CAP payments

- Top 10% of farms received 54% of total CAP payments

- Bottom 80% of farms (smaller operations) received 20% of total payments

Examples of CAP Recipients:

Not struggling family farms. Corporate agriculture and even non-farmers:

According to Farmsubsidy.org database tracking EU agricultural payments:

Queen Elizabeth II's estate: Received £6.3 million CAP subsidies (before her death)

Prince Albert II of Monaco: €287,308 in CAP payments for his French estates

Cutrale (orange juice giant): €1.2 million for Spanish citrus plantations

Princes Sturdza (Romanian aristocrat): €679,028 for farmland holdings

Large agribusinesses, wealthy landowners, even banks owning farmland receive massive CAP subsidies.

Meanwhile small French vegetable farmer gets €2,000 annually, if bureaucracy doesn't disqualify him.

The Bureaucratic Burden:

CAP compliance requires extensive documentation:

- Detailed field mapping (GPS coordinates)

- Crop rotation records

- Fertilizer application logs

- Pesticide use documentation

- Environmental compliance certifications

- Cross-compliance with 18 different EU regulations

- Annual declarations and inspections

For large corporate farm with dedicated administrative staff? Manageable.

For 55-year-old French farmer managing 30 hectares alone? Impossible.

According to Copa-Cogeca surveys of European farmers, administrative burden is cited as top reason for farm abandonment among small operators. Can't afford compliance officers. Can't manage paperwork while actually farming. Choose to quit.

The "Greening" Requirements:

CAP 2014-2020 introduced "greening" requirements: ecological focus areas, crop diversification, permanent grassland maintenance.

Sounds environmental. Implementation crushes small farms.

Example: Crop diversification requirement mandates farms over 30 hectares grow at least three different crops.

Specialized vineyard in France growing only grapes? Doesn't qualify for full subsidies unless diversifying.

Small organic farm focused on specific vegetables for local markets? Must diversify or lose payments.

Industrial mega-farm growing wheat, corn, rapeseed? Already diversified. Full payments.

According to BirdLife Europe analysis of greening impact, greening requirements provided minimal environmental benefit while increasing compliance costs disproportionately for small farms.

The Consolidation Acceleration:

CAP structure actively encourages consolidation:

- Subsidies favor large landholdings (more hectares = more money)

- Bureaucracy burdens small farms (can't afford compliance)

- Environmental rules require scale (efficiency regulations benefit large operations)

Result: Small farms sell to larger neighbors or investment funds.

According to European Parliament research on farm structures:

- Number of farms in EU declined 37% from 2005-2020 (from 14.6M to 9.1M farms)

- Average farm size increased 38% in same period

- Farms under 5 hectares decreased most (-40%)

- Farms over 100 hectares increased most (+15%)

Family farms disappearing. Industrial agriculture expanding. CAP subsidizes this transformation with €387 billion while calling it "rural development."

The Lobbying Capture:

Who shapes CAP policy? Not small farmers.

According to Corporate Europe Observatory research on CAP lobbying, agribusiness lobby groups dominate:

Copa-Cogeca (farmers/cooperatives confederation): Largest lobby, but represents big farm interests

European Landowners Organization: Wealthy estate owners

Fertilizers Europe: Chemical industry (BASF, Yara, etc.)

COCERAL: Grain traders (including ABCD subsidiaries)

FoodDrinkEurope: Food processors and supermarkets

Small farmer organizations exist but are outspent and outmaneuvered.

The policies serve those who shape them: large landowners, agribusiness, commodity traders.

The Reform That Never Comes:

Every CAP reform cycle (every 7 years), promises are made:

"Support small farms"

"Environmental sustainability"

"Rural vitality"

"Fair payments"

Every cycle, the result is the same: bigger farms get more, small farms get squeezed harder, consolidation accelerates.

CAP 2023-2027 negotiations produced no fundamental change. Subsidies still favor size. Bureaucracy still burdens small. Environmental rules still lack teeth against industrial agriculture.

According to analysis by ARC2020 (Agricultural and Rural Convention), CAP 2023-2027 is "business as usual" despite rhetoric of transformation.

The €387 billion continues subsidizing exactly what's destroying European farming.

The Farmer Suicide Epidemic: When Fields Become Graveyards

The statistics are horrifying:

France: 1 farmer suicide every 2 days (data from Mutualité Sociale Agricole, French agricultural social security)

Ireland: Farmers have suicide rate 3x national average (Teagasc research)

UK: 1 farmer suicide per week (Farm Safety Foundation data)

Netherlands: Mental health crisis as farmers face land seizures and bankruptcy

Germany: Dairy farmer suicides rising as milk prices collapse

This isn't random tragedy. It's systemic destruction.

The Debt Crisis:

According to European Parliament research on farm economics, average EU farm debt increased 40% from 2010-2020 while income declined or stagnated.

The debt comes from:

- Seeds and chemicals (annual purchase, increasing costs)

- Machinery (modern equipment costs hundreds of thousands)

- Land (prices inflated by investment fund speculation)

- Compliance costs (environmental regulations, certifications)

Revenue comes from:

- Crop sales to commodity traders (prices set globally, below control)

- Livestock sales to processors (prices dictated by large buyers)

When debt grows and income shrinks, the gap becomes unbridgeable.

The French Crisis:

France has 400,000 farms. According to Mutualité Sociale Agricole (MSA) data, 600+ French farmers commit suicide annually, nearly 2 per day.

Why?

Dairy crisis: Supermarkets pay €0.28-0.32/liter, production cost €0.40/liter. Farmers lose money on every liter. Can't quit (debt), can't continue (bankruptcy).

Grain collapse: EU grain prices fell 30% from 2013-2016 as global supply surged. French farmers couldn't cover costs. Borrowed to survive. Debt spiraled.

Regulatory burden: French agriculture has strictest environmental and animal welfare rules in EU. Costs increase. Competing with imports from countries without regulations.

Generational pressure: Family farms spanning centuries. Father can't pass profitable farm to son, only debt. Shame, failure, despair.

According to testimony collected by French farmer unions, common pattern before suicide:

- Debt becomes unmanageable

- Bank threatens foreclosure

- Shame prevents asking for help

- Isolation increases (rural depopulation means fewer neighbors)

- Mental health deteriorates

- Suicide seen as only way to end burden on family

Average age of French farmer suicide: 47 years old. Prime of life. Destroyed by system they can't control.

The Netherlands Nitrogen Crisis:

Dutch government announced plans to reduce nitrogen emissions 50% by 2030. Sounds environmental. Implementation means closing 30% of Dutch farms, 11,200 farms forced to shut down.

Government offers buyout: €120,000 per hectare. Sounds generous.

Reality:

- Average buyout insufficient to pay farm debt

- Farmers lose livelihood with no alternative

- Rural communities die as farms close

- Land grabbed by government for housing development (real goal)

According to Dutch farmers' protests documentation, farmers responded with massive uprising:

- Tractor blockades of highways

- Protests in The Hague

- Blocking food distribution centers

- International solidarity (farmers across Europe joined)

Government response: Deploy police, arrest protesters, seize tractors, label farmers "terrorists."

The protests continue. The closures proceed. And farmer mental health crisis worsens.

The Irish Pattern:

Ireland has 137,000 farms. According to Teagasc (Irish Agriculture and Food Development Authority) research, Irish farmers have:

- Suicide rate 3x national average

- Depression rates 5x general population

- Help-seeking rate near zero (stigma, rural isolation)

The drivers:

Dairy volatility: Irish dairy is export-dependent. Global milk prices fluctuate wildly. Farmers can't budget, can't plan, can't survive volatility.

Debt burden: Average Irish dairy farm debt: €200,000+. Interest payments alone consume profit in bad years.

Isolation: Rural Ireland depopulating. Nearest neighbor kilometers away. Mental health support nonexistent.

Weather and disease: 2018 drought killed grass, forced early slaughter, devastated finances. Farmers with no reserves broke.

According to survivor testimonies collected by farm support groups, common triggers:

- Debt collector letter

- Bank foreclosure notice

- Diagnosis of animal disease (TB, requiring herd culling)

- Crop failure or weather disaster

- Relationship breakdown from financial stress

Many suicides occur in barn or field. Found by family. Trauma compounding tragedy.

The German Dairy Crisis:

Germany had 150,000 dairy farms in 2000. Now: 55,000. Two-thirds gone.

The survivors face:

Milk price collapse: Aldi sells milk €0.65/liter. Farmers receive €0.35/liter. Production cost: €0.45/liter. Every liter is 10-cent loss.

Quota abolition: EU abolished milk quotas 2015. Production surged. Prices collapsed. Small farms couldn't survive.

Consolidation pressure: Only mega-dairies with 500+ cows achieve efficiency for survival. Family farms with 50 cows non-viable.

According to German Farmers Association (DBV), dairy farmer suicides spiked 2015-2016 as quota abolition effects hit. Official statistics undercount (many rural suicides not classified as farmer-specific).

The Support That Doesn't Exist:

Rural areas lack mental health services. Stigma prevents help-seeking ("farmers don't need therapy"). Farm organizations focus on policy advocacy, not mental health support.

According to European Forum for Rural Health, rural suicide prevention is massively underfunded compared to urban programs.

Farmers die alone, in debt, in despair, while the system that destroyed them continues unchanged.

These Aren't Accidents:

Every farmer suicide is a person failed by a system designed to eliminate them.

The debt trap, the price control, the regulatory burden, the supermarket squeeze, the import competition, the land grab, the consolidation, these are policy choices with predictable consequences.

And the suicides continue.

"The most beautiful people we have known are those who have known defeat, known suffering, known struggle, known loss, and have found their way out of the depths. These persons have an appreciation, a sensitivity, and an understanding of life that fills them with compassion, gentleness, and a deep loving concern. Beautiful people do not just happen." - Elisabeth Kübler-Ross

The farmers dying weren't given the chance to find their way out.

The Import Dependency Trap: Europe Cannot Feed Itself

Europe produces food. Europe has agricultural capacity. Europe has farming tradition spanning millennia.

Yet Europe imports basic staples from thousands of miles away, creating vulnerability and destroying food sovereignty.

The Numbers:

According to Eurostat trade statistics, EU agricultural imports 2022:

Fruit and vegetables: €65 billion imported

Meat: €18 billion imported

Cereals: €12 billion imported

Dairy: €8 billion imported

Total EU agricultural imports: €184 billion annually

This isn't tropical fruit or coffee. This is tomatoes, chicken, wheat, cheese, foods Europe produces.

Where It Comes From:

Tomatoes: Morocco (51% of EU tomato imports), Turkey, Tunisia

Chicken: Brazil (45% of poultry imports), Thailand, Ukraine

Wheat: Ukraine (30% of EU wheat imports pre-war), Russia, Canada

Oranges: South Africa, Egypt, Morocco

Beef: Argentina, Brazil, Uruguay

Soybeans: Brazil (85% of EU soy imports), United States, Argentina

Europe's food supply is globalized, distant, vulnerable.

The Ukraine War Shock:

February 2022: Russia invades Ukraine. Black Sea grain exports blocked.

Ukraine supplied 30% of EU wheat imports, 50% of sunflower oil, massive corn volumes.

Suddenly: gone.

Result according to European Commission market monitoring:

- Wheat prices spiked 50% in weeks

- Sunflower oil disappeared from shelves

- Bread prices increased 20-30%

- Pasta prices doubled (durum wheat shortage)

- Livestock feed crisis (corn shortage)

Europe discovered its food security was illusory. Dependent on regions vulnerable to war, climate, political instability.

The Morocco Leverage:

Morocco supplies over 50% of EU tomato imports. Also major supplier of berries, citrus, vegetables.

This gives Morocco political leverage. According to analysis by Observatory for Political Ecology, Morocco uses food exports as diplomatic tool:

- EU migrant policy negotiations: Morocco threatens to open migration flows or withhold cooperation unless EU concessions

- Western Sahara conflict: EU support for Morocco's position connected to food trade deals

- Trade agreements: Morocco demands favorable terms leveraging EU food dependency

Europe can't easily replace Moroccan tomatoes, Spanish farms already destroyed by Moroccan competition.

The Supply Chain Fragility:

Long-distance food supply chains require:

- Stable transport (shipping, trucking)

- Energy (refrigeration, processing)

- Political stability (export controls, tariffs)

- Climate predictability (droughts, floods affect distant suppliers)

Any disruption = food crisis.

COVID-19 lockdowns 2020 showed fragility:

- Shipping delays

- Port congestion

- Labor shortages in processing

- Panic buying and hoarding

If pandemic had lasted longer or been more severe, food supply would have collapsed.

According to FAO analysis on food supply chain resilience, global food system is increasingly vulnerable to systemic shocks with limited redundancy.

The Lost Capacity:

European farms that closed don't easily restart. Once land is abandoned or repurposed, once farmers quit or die, once knowledge is lost, rebuilding is difficult or impossible.

Spain's abandoned farmland: thousands of hectares of former vegetable farms now empty. Can't quickly revive when Moroccan imports disrupted.

France's reduced dairy: closed farms don't reopen. Liquidated herds aren't reassembled. Lost capacity is lost permanently.

According to European Environment Agency land use data, agricultural land in EU declined 11% from 2000-2020, converted to urban, abandoned, or rewilded.

Self-sufficiency declining. Import dependency increasing.

The Strategic Stupidity:

Food is strategic resource. Countries that can't feed themselves are vulnerable to:

- Economic coercion (trade sanctions, price manipulation)

- Political pressure (food access conditional on compliance)

- Supply disruption (war, climate, disease)

Historic famines often resulted from distribution failure not production failure. When food is controlled by distant actors, local population starves despite global surplus.

Europe trading food sovereignty for slightly cheaper tomatoes is strategic stupidity.

But supermarkets profit from global sourcing. Commodity traders profit from long supply chains. Agribusiness profits from consolidation.

So import dependency increases, and nobody with power cares that Europe can't feed itself.

The Quality Decline: Why Food Tastes Worse and Nutrients Vanish

Remember when tomatoes tasted like tomatoes? When strawberries were sweet and fragrant? When bread had texture and flavor?

Compare to supermarket today. Tomatoes taste like water. Strawberries are massive but flavorless. Bread is spongy and bland.

This isn't nostalgia. Quality measurably declined.

The Variety Selection:

Food is bred for:

Transport tolerance: Tomatoes picked unripe, shipped thousands of miles, gassed with ethylene to turn red. Variety must withstand handling, not taste good.

Shelf life: Tomatoes sit in warehouse, distribution center, supermarket for weeks. Must not rot. Flavor genes linked to perishability eliminated.

Appearance: Consumers (supposedly) want perfect uniform size, color, shape. Varieties selected for looks not taste.

Yield: Maximize output per hectare. High-yield varieties produce more volume but lower nutrient density.

According to research by Jules Pretty on agricultural intensification, modern crop breeding prioritizes yield and durability, actively selecting against flavor and nutrition when these traits conflict with commercial priorities.

The Nutrient Loss:

Historical analysis comparing nutrient content of crops today vs. 1950s shows declining nutrition across nearly all foods.

According to research by Donald Davis in Journal of the American College of Nutrition, comparing USDA data 1950 vs. 1999:

Vegetables decline:

- Protein: -6%

- Calcium: -16%

- Iron: -15%

- Vitamin C: -20%

- Riboflavin: -38%

Fruits decline:

- Protein: -6%

- Calcium: -11%

- Iron: -24%

- Vitamin C: -15%

Why? Varieties selected for yield produce more mass but same nutrient total, diluting concentration. "Dilution effect", more water, carbohydrate, less micronutrients.

Also: soil depletion from industrial monoculture. Nutrients not replenished, crops grown in exhausted soil contain fewer minerals.

The Pesticide Residue:

Industrial agriculture relies on pesticides. According to European Food Safety Authority (EFSA) pesticide residue monitoring, 46% of food samples contained detectable pesticide residues (2020 data).

Residues are "within legal limits." But:

- Legal limits set to prevent acute toxicity, not chronic low-level exposure

- Testing is single-chemical, doesn't measure combined effects of multiple residues

- Pesticides include endocrine disruptors, neurotoxins, carcinogens

According to PAN Europe (Pesticide Action Network) analysis, certain imported fruits and vegetables (grapes from Turkey, strawberries from Spain, peppers from Netherlands) routinely contain multiple pesticide residues including banned substances.

You're eating chemistry along with food.

The Industrial Processing:

Fresh food becomes "value-added" products:

- Tomatoes → canned, purée, sauce, ketchup (stripped of fiber, nutrients)

- Wheat → white flour (removing bran and germ where nutrients concentrate)

- Fruit → juice (removing fiber, concentrating sugar)

- Meat → processed (adding salt, preservatives, fillers)

Each processing step removes nutrients, adds chemicals, reduces food to calories.

According to research by Carlos Monteiro on ultra-processed foods, ultra-processed foods now constitute 50%+ of calories in European diets (UK, Germany, France).

These foods are:

- Higher in calories

- Lower in nutrients

- Higher in salt, sugar, fat

- Linked to obesity, diabetes, cardiovascular disease, cancer

The Transport Degradation:

Nutrients degrade over time. Food shipped from Argentina to Europe spends:

- Days in harvest/packing

- Weeks in shipping container

- Days in port/customs

- Days in distribution warehouse

- Days in supermarket storage

- Days in your refrigerator

Vitamin C degrades quickly (leafy greens lose 50% within week of harvest). By the time you eat that Kenyan green bean, nutrient content is fraction of fresh.

According to studies on nutrient retention in transport, time from farm to plate determines nutrient preservation more than variety or growing method.

Local food eaten fresh has higher nutrition than distant food warehoused for weeks regardless of organic certification.

The Taste Consequence:

Flavor compounds (volatile organic molecules creating taste/aroma) are linked to nutrient content and freshness.

Low-nutrient varieties taste bland. Degraded nutrients equal degraded flavor. Food picked unripe never develops full flavor regardless of ripening later.

According to research by Harry Klee on tomato flavor genetics, modern tomato varieties lost flavor because breeding for yield and shelf-life inadvertently eliminated genes producing volatiles that create tomato taste.

This happened across many crops. Food engineered for commodity traders and supermarket logistics, not human enjoyment.

The Comparison:

Buy tomato from farmers market (local, fresh, heritage variety, picked ripe):

- Intense flavor

- Complex aroma

- Higher nutrients

- No pesticides or minimal organic

- Costs €4/kg

Buy tomato from supermarket (Moroccan, industrial, hybrid variety, picked unripe):

- Watery tasteless

- No aroma

- Lower nutrients

- Pesticide residues

- Costs €2/kg

Cheaper tomato costs more in lost nutrition, flavor, health. But supermarket offers convenient consistent product year-round.

Convenience replaced quality. And most consumers don't even know what they lost.

The Farmer Protests: Suppressed Rage Across Europe

Farmers are fighting back. Tractor blockades. Highway occupations. Supermarket protests. Government sieges.

Media coverage? Minimal. Dismissed as backwards farmers resisting progress.

Reality? People defending their livelihoods and food sovereignty against corporate takeover.

France - The Tractor Blockades:

January-February 2024: Massive French farmer protests. Thousands of tractors blockaded highways around Paris, Toulouse, Lyon, Bordeaux.

Demands:

- Fair prices covering production costs

- End to unfair competition from imports not meeting EU standards

- Simplification of bureaucracy

- Opposition to EU-Mercosur trade deal (would flood EU with Brazilian beef)

Government response:

- Minor concessions (reducing some paperwork)

- Promises of price floor mechanisms (not implemented)

- Crackdown on protests (police deployed)

According to FNSEA (French farmers union) documentation, protests involved 40,000+ farmers and 25,000+ tractors at peak. Forced government attention but achieved minimal real change.

Netherlands - The Nitrogen Uprising:

2019-present: Dutch farmers protesting government nitrogen emission reduction plans forcing closure of 30% of farms.

Tactics:

- Tractor convoys to The Hague

- Blocking food distribution centers

- Highway occupations

- International solidarity (German, Belgian, French farmers joined)

- Political party formation (Farmer-Citizen Movement won provincial elections 2023)

Government response:

- Police crackdowns (rubber bullets, arrests)

- Labeling protesters "terrorists"

- Seizing tractors

- Proceeding with closures despite protests

According to LTO Nederland (Dutch farmers organization), farmer protests are largest Netherlands has seen in decades. Yet government proceeds with farm elimination plan.

Poland - Blocking Ukrainian Grain:

February-March 2024: Polish farmers blocked roads at Ukraine border, preventing Ukrainian grain trucks entering EU.

Why?

- Ukraine grain floods Polish market (duty-free under wartime EU support)

- Polish grain prices collapsed (-30%)

- Polish farmers can't compete with Ukrainian volumes

- EU rhetoric supports Ukraine, policy destroys Polish farming

Government response:

- Sympathy but no action (EU-Ukraine trade rules set in Brussels)

- Temporary import limits (expired, not renewed)

- Protests continuing

According to KRIR (Polish farmers chambers) statements, Ukrainian grain imports threaten Polish food sovereignty while benefiting Ukrainian oligarchs and commodity traders.

Germany - The Diesel Subsidy Revolt:

December 2023-January 2024: German farmers protested government plan to eliminate agricultural diesel subsidies.

Impact:

- Subsidy removal adds €440 million annual cost to farmers

- Already-struggling farms pushed toward bankruptcy

- Government justification: "green" budget consolidation

Protests:

- Tractor blockades in Berlin

- Highway disruptions nationwide

- Strikes and demonstrations

Government response:

- Partial rollback (phased removal instead of immediate)

- Subsidies still being eliminated gradually

- Farmers lose regardless

According to Deutscher Bauernverband (German farmers association), diesel subsidy removal is symbolic larger issue: government treating farmers as expendable while subsidizing industry and imports.

Spain - Protesting Moroccan Competition:

Ongoing: Spanish farmers protesting Moroccan imports undercutting prices.

Spanish tomato production cost: €1.20/kg

Moroccan tomato import price: €0.60/kg

Supermarket retail price: €2.50/kg

Spanish farmers can't compete. Supermarkets profit from Moroccan margins.

Protests:

- Roadblocks near Moroccan entry points

- Demonstrations at supermarket distribution centers

- Demands for country-of-origin labeling and fair competition

According to COAG (Spanish farmers union), Moroccan imports benefit from:

- Lower labor costs (exploited workers)

- Lower environmental standards

- Lower food safety oversight

- EU trade agreements favoring Morocco

Spanish farms close while Morocco gains market share.

Italy - Protecting Local Food:

Italian farmers less organized in mass protests but constant resistance to:

- Import competition (tomatoes from China processed as "Italian")

- Industrial agriculture replacing traditional methods

- Loss of food culture and regional varieties

According to Coldiretti (Italian farmers confederation), Italian farmers defend food quality and tradition but face supermarket price pressure and CAP bureaucracy.

The Pattern Across Europe:

Every country has farmer protests. Every protest shares demands:

- Fair prices

- End to import dumping

- Reduction of bureaucracy

- Respect for farming as profession

- Food sovereignty

Every protest faces:

- Minimal media coverage

- Government promises without action

- Police crackdowns

- Dismissal as "backward resistance"

- Policy continuation regardless

Why Protests Fail:

Farmers don't control policy. Corporate lobbies do.

Supermarkets don't want fair prices (cuts margins). Commodity traders don't want local food (cuts volumes). Agribusiness doesn't want small farms (prefers consolidation). Investment funds don't want farmer ownership (want land acquisition).

And EU doesn't want food sovereignty (wants free trade serving corporate interests).

So farmers protest, and nothing changes. The destruction continues.

"First they ignore you, then they laugh at you, then they fight you, then you win." - Nicholas Klein, 1918 (often misattributed to Gandhi)

European farmers are at stage 3 (they fight you). Stage 4 hasn't arrived.

And time is running out.

Why Local Food Costs More: The Rigged Economics

Here's the paradox:

Local food: Grown 50km away, fresh, no transport costs, seasonal

Cost: €3/kg

Import food: Grown 5,000km away, shipped, stored, transported

Cost: €1.50/kg

How is distant food cheaper than local? The economics don't make sense unless the system is rigged.

It is.

The Subsidy Arbitrage:

Foreign farms are subsidized:

Morocco subsidizes agricultural water (farming uses 80% of water, pays 10% of cost). Subsidizes fertilizers. Subsidizes diesel. Subsidizes electricity for irrigation.

Brazil subsidizes rainforest clearing (free land for agriculture). Subsidizes agricultural credit (low-interest loans). Subsidizes infrastructure (roads to ports).

These subsidies aren't reflected in crop price. European supermarkets buy at artificially low price, taxpayers in Morocco and Brazil having paid production costs.

European farms face costs without subsidies:

While CAP exists, 80% goes to largest farms. Small farms producing for local markets get minimal support while facing full costs:

- Water (not subsidized, priced by volume)

- Electricity (market rate, no agricultural discount)

- Diesel (taxed, subsidy being removed)

- Labor (minimum wage laws, social contributions)

Local farmer pays real costs. Foreign competitor has costs socialized.

The Regulatory Arbitrage:

European farms must comply with:

- Pesticide regulations (restricted substances, application limits)

- Animal welfare standards (space per animal, outdoor access, humane slaughter)

- Environmental protections (water use limits, nitrate runoff controls)

- Food safety standards (HACCP, traceability, testing)

- Labor laws (minimum wage, working conditions, social security)

Compliance costs money. According to European Commission regulatory impact assessments, environmental and food safety compliance adds 20-30% to EU farm production costs.

Imports face minimal compliance:

Moroccan farms use pesticides banned in EU. Brazilian farms clear rainforest illegally. Thai chicken factories have animal welfare standards EU consumers would find horrific.

But once food crosses border, it's checked for:

- Pesticide residues (below "safe" limits, but substances banned for EU farmers)

- Pathogen contamination (spot-checked, not comprehensive)

Structural standards (how it was produced) largely ignored. According to research by ClientEarth on import standards, EU import controls test product, not production methods, creating massive regulatory arbitrage.

The Labor Arbitrage:

European labor costs:

French farm worker: €12/hour minimum + social charges (€18-20/hour total cost to employer)

German farm worker: €12.41/hour minimum + social charges (€19-22/hour total)

Import competitor labor costs:

Moroccan farm worker: €2/day (yes, per day, not hour)

Brazilian farm worker: €3-4/day

Thai farm worker: €5-8/day

Labor is largest component of fruit/vegetable production cost. When labor costs are 90% lower, produce can be sold at fraction of price while maintaining margins.

European farmer employing legal workers at legal wages cannot compete with imports produced by exploited labor.

The Transport Subsidy:

Shipping is artificially cheap because:

Marine fuel is untaxed: Shipping uses bunker fuel (heavy fuel oil) that's untaxed internationally. According to Transport & Environment analysis, if shipping paid fuel tax like trucks, costs would increase 40-60%.

Port infrastructure subsidized: Ports receive massive public investment. Rotterdam, Hamburg, Antwerp built and maintained with public money but used by private shipping.

Trade agreements favor imports: EU-Morocco trade deal gives Moroccan agricultural exports preferential access (low/zero tariffs) undermining European farmers.

So tomatoes ship from Morocco for less cost than truck from Spain to France despite 10x distance.

The Scale Advantage:

Import system optimized for volume:

Commodity traders buy entire shiploads. Supermarkets buy container-loads. Processing happens at scale. Distribution is optimized.

Volume creates efficiency.

Local system fragmented:

Small farms produce small volumes. Each farmer transports own produce or sells to small distributor. No economies of scale.

But this fragmentation is partly result of system destroying small farmer cooperation while favoring large-scale imports.

The Supermarket Margin Extraction:

Supermarkets extract higher percentage margin on local food than imports.

Why?

Local food marketed as "premium" (fresh, sustainable, local). Supermarket charges premium price.

But doesn't pay farmers premium. Pays same or lower than import price, keeps premium as margin.

According to Friends of the Earth research on supermarket pricing, supermarkets routinely charge 50-100% premium for "local" food while paying farmers 0-10% premium over import price.

Example:

Spanish tomatoes cost supermarket €0.60/kg (local)

Moroccan tomatoes cost supermarket €0.40/kg (import)

Supermarket sells Spanish as "local premium" for €3.50/kg (483% markup)

Supermarket sells Moroccan as standard for €2.50/kg (525% markup)

Higher absolute margin on local, higher percentage margin on import. Supermarket wins both ways. Farmer loses.

The Rigged System:

Local food would be cheaper than imports if:

- Foreign subsidies weren't allowed

- Regulatory standards were enforced equally

- Labor exploitation wasn't rewarded

- Transport was taxed fairly

- Supermarkets paid farmers fairly

But the system is designed to favor imports, consolidation, and corporate control.

Not market efficiency. Market rigging.

And consumers pay more for worse food while farmers go bankrupt producing better food that costs less to produce.

That's the cartel.

What You Need to Know

Your food is controlled by a cartel operating across multiple levels of extraction.

Four commodity trading companies (Cargill, ADM, Bunge, Louis Dreyfus) control 70%+ of global grain trade, setting prices globally, owning storage and transport chokepoints, speculating on food while farmers are price-takers with no bargaining power. Their 2008 profits surged 65-86% during food price crisis causing riots in 30+ countries while people starved.

Five supermarket chains (Schwarz/Lidl, Carrefour, Tesco, Aldi, Ahold Delhaize) dominate 60-70% of European retail, demanding prices below farmer production cost, extracting 50-70% margins while farmers receive 12-18% of retail price, favoring imports with higher margins over local food, and using vertical integration to own entire supply chains.

Four agribusiness giants (Bayer-Monsanto, Corteva, Syngenta, BASF) control 60% of global seed market through patents preventing seed-saving and forcing annual repurchase, engineer chemical dependency where seeds require specific pesticides/fertilizers they also sell, and create debt traps driving farmer bankruptcies globally including 350,000+ Indian farmer suicides since 1995.

EU Common Agricultural Policy spends €387 billion (31% of total EU budget) with 80% going to 20% largest farms, burying small farms in bureaucratic compliance costs, implementing environmental regulations impossible for family operations, and accelerating consolidation from 14.6 million EU farms in 2005 to 9.1 million in 2020 (-37%) while average farm size increased 38%.

Farmer suicide epidemic with French farmers dying at rate of 1 every 2 days from debt and bankruptcy, Irish farmers having suicide rate 3x national average, Netherlands farmers facing mental health crisis from land seizures, German dairy farmers watching two-thirds of operations disappear 2000-2023, all driven by debt spirals from input costs rising while commodity trader prices and supermarket payments fall below production costs.

Import dependency destroyed European food sovereignty with €184 billion annual agricultural imports including basic staples Europe produces, creating vulnerability proven by Ukraine war grain crisis when 30% of wheat imports and 50% of sunflower oil disappeared causing price spikes and shortages, giving foreign suppliers like Morocco political leverage, and eliminating production capacity permanently as abandoned farms don't easily restart.

Food quality measurably declined with nutrient content falling 6-38% since 1950s due to varieties selected for yield/transport/shelf-life not nutrition/flavor, 46% of food containing pesticide residues, ultra-processed foods constituting 50%+ of calories, and taste degrading as flavor genes eliminated through breeding for commercial priorities rather than eating quality.

Farmer protests suppressed across France (tractor blockades demanding fair prices), Netherlands (uprising against farm closures), Poland (blocking Ukrainian grain imports), Germany (diesel subsidy protests), Spain (Moroccan competition resistance), all achieving minimal results because corporate lobbies control policy not farmers, media coverage dismisses protests as backward resistance, and governments make promises without action while destruction continues.

Local food costs more than imports despite economics favoring local because foreign farms are subsidized (Morocco water/fertilizer, Brazil land-clearing/credit), regulatory standards not enforced equally (EU farmers comply with expensive rules, imports avoid), labor exploitation rewarded (€2/day Morocco vs €18-20/hour France), transport artificially cheap (untaxed marine fuel, subsidized ports), and supermarkets extract premium margins on "local" while paying farmers same or less than import prices.

The system is designed for corporate extraction not food production, farmer elimination not rural vitality, import dependency not sovereignty, consolidation not diversity, profit maximization not food security or quality.

European farms that fed continent for millennia are being systematically destroyed while food control transfers to commodity traders, supermarkets, agribusiness giants, and investment funds treating agriculture as asset class for rent extraction rather than essential public good.

Farmers are committing suicide. Rural communities are dying. Food security is evaporating. Quality is declining. And corporate profits are record highs.

This is the supermarket cartel. They control what you eat. They decide what farmers can grow. They extract maximum profit at every stage. And they're eliminating any alternative to their control.

Related Investigations:

The Bologna Process: How Corporations Captured Education

The ECB Dictatorship: How Unelected Bankers Control 340 Million People

The Pension Theft: How Boomers Sold Their Children's Future

The WEF Davos Dictatorship: When Billionaires Make Policy

Independent. Unfunded. Uncompromising.

Investigating power. Exposing corruption. Demanding accountability.

No ads. No sponsors. Just signals from the noise.

Keep The Kade Frequency transmitting.

© 2026 The Kade Frequency. All rights reserved.