The Austerity Swindle: How Europeans Freeze While Corporations Feast

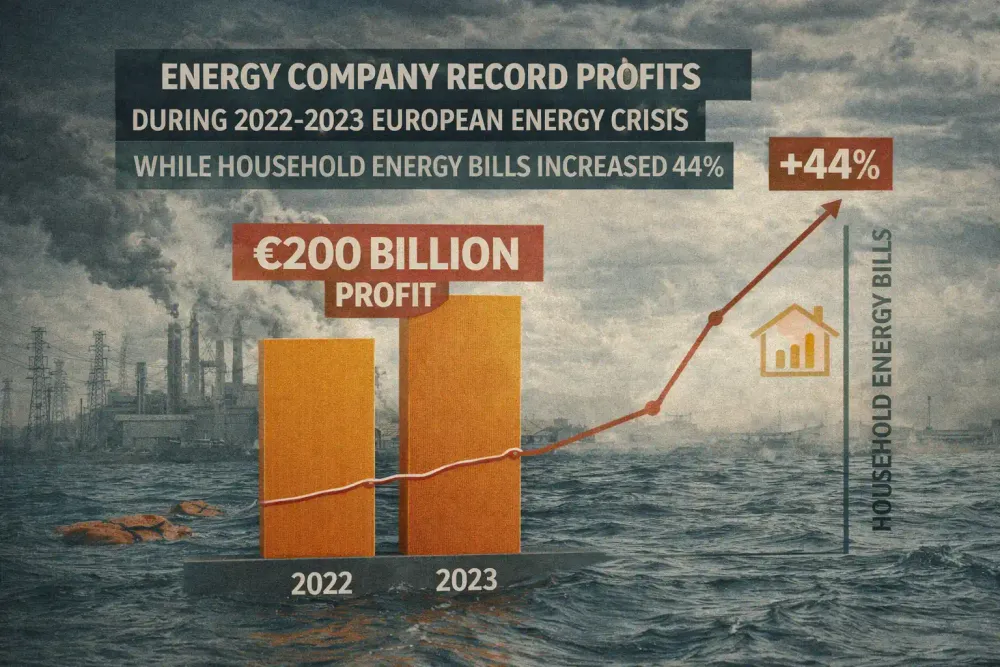

While European families lowered thermostats and skipped meals, energy companies posted €200B in record profits. This investigation documents how the 2022-2023 crisis became a €238B annual wealth transfer from households to corporations, enabled by regulatory capture, failed competition enforcement.

While you're told to lower your thermostat and watch every cent, energy companies are posting the fattest profits in their history. This isn't economics. This is organized theft. And the people telling you to sacrifice are the same ones who made sure the thieves got away with it.

The story Europe's institutions are selling goes like this: we're all in this together, times are tough, everyone needs to tighten their belts, shared sacrifice for the common good. You've heard it a thousand times from politicians, bureaucrats, and the corporate media outlets Brussels funds with your tax money. Lower the heat. Cut the lights. Skip the vacation. Maybe skip a meal.

But here's what they're not telling you: the wealth isn't disappearing. It's being systematically transferred from your bank account into corporate balance sheets while the transfer mechanism gets hidden behind crisis narratives and technocratic bullshit.

You're not participating in shared sacrifice. You're being robbed in broad daylight by companies that spent the "crisis" years posting record profits they couldn't have imagined before the crisis started.

The truth doesn’t trend. It survives because a few still care enough to keep it alive.

Keep The Kade Frequency transmitting.

This is the story of how austerity became state religion for citizens and corporate welfare became policy for the connected. How European families were told there's no money for heating assistance while energy companies walked away with €200 billion in windfall profits. How you're lectured about inflation while corporations are driving it with profit margin expansion. How "competitiveness" means subsidies for Siemens but sacrifice for you.

The mechanisms are documented. The numbers are public. The politicians responsible have names. And every single one of them is counting on you being too exhausted from trying to pay your electricity bill to notice you're being played.

The Energy Heist Nobody's Prosecuting

Let's start with the most obvious theft because it's happening right now, every month, when your energy bill arrives and you wonder what the fuck happened.

In 2022, while European governments begged citizens to reduce energy consumption and lower thermostats to survive the winter, five major energy companies operating in Europe posted combined profits of $196 billion. Not revenue. Profit.

Shell cleared $39.9 billion. BP took $27.7 billion. TotalEnergies grabbed $20.5 billion. Equinor walked with $74.9 billion. Exxon, with significant European operations, banked $55.7 billion.

These aren't normal profits adjusted for inflation. These are the highest profits these companies have ever recorded in their entire histories. The "energy crisis" that forced you to choose between heating and eating created a profit bonanza that executives couldn't have fantasized about in their most optimistic projections.

The mechanism was simple: energy prices spiked due to supply disruptions and geopolitical instability, but the companies didn't just pass along increased costs. They exploited the crisis to expand profit margins to historic levels.

When wholesale natural gas prices jumped, retail prices jumped higher. When wholesale prices stabilized, retail prices stayed elevated. The crisis became the excuse for permanent wealth extraction.

Here's what makes it theft rather than market dynamics: these companies operate in heavily regulated markets where governments set the rules. European competition authorities could have intervened. National regulators could have imposed price caps or excess profit taxes. The European Commission could have used emergency powers to protect consumers.

They didn't. Or rather, they did the absolute minimum while ensuring corporate profits stayed protected.

The Windfall Tax That Wasn't

When public pressure became impossible to ignore, European governments announced "windfall profit taxes" with great fanfare. Finally, the thinking went, someone's going to make these bastards pay.

Except the taxes were designed not to work.

The EU's temporary solidarity contribution on fossil fuel companies, introduced in September 2022, set a 33% tax on profits exceeding a 20% increase over average profits from 2018-2021. Sounds tough until you examine the escape hatches built into the legislation.

First problem: the tax only applied to 2022 and 2023 profits, giving companies a clear end date to wait out. Second problem: it only targeted fossil fuel extraction and refining, not the trading operations where massive profits hide.

Third problem: national governments got to implement it, meaning countries competing for corporate headquarters watered it down or delayed implementation.

The result? The tax raised approximately €40 billion across the EU, about 20% of the actual windfall profits energy companies extracted. Shell, BP, and TotalEnergies paid far less than their profit explosion would suggest because their corporate structures spread profits across jurisdictions where the tax didn't apply or applied at reduced rates.

Britain provides the perfect case study in regulatory capture. The UK's Energy Profits Levy, introduced in May 2022, set a 25% tax on oil and gas profits. But the tax included an "investment allowance" that let companies deduct 80% of qualifying investments from taxable profits.

Shell and BP immediately announced major North Sea investments that would shelter future profits while generating tax deductions that offset current tax liability. The companies got credit for investing money they were going to invest anyway, turning a windfall tax into a subsidy program.

By late 2023, the UK government admitted the levy would raise £26 billion less than initially projected because the investment allowances were more generous than the taxes collected.

This is how the game works: announce strong action to calm public anger, design the policy to fail, then shrug when it doesn't raise projected revenue. The energy companies understand this perfectly. Their lobbyists often help draft the legislation that's supposedly targeting them.

Your Bill Went Up, Their Costs Didn't

The excuse you heard for skyrocketing energy bills was supply chain disruption and increased input costs. Gas got expensive because of geopolitical instability. Electricity got expensive because gas-fired generation became more costly. Simple market economics, nothing anyone could do about it.

Bullshit. The numbers don't support the narrative.

A 2023 analysis by the International Monetary Fund found that corporate profit expansion accounted for almost 45% of eurozone inflation in 2022-2023. Not supply chain disruptions. Not increased labor costs. Not commodity price spikes.

Corporate profit margins expanding beyond anything justified by their actual cost increases.

For energy specifically, the markup was even more extreme. Residential electricity prices across the EU increased by an average 44% between 2021 and 2023. But the actual cost of generating that electricity didn't increase proportionally for most producers.

Renewable energy generators had no fuel cost increases. Nuclear plants had minimal cost changes. Even gas-fired plants were passing along wholesale price spikes while adding margin expansion on top.

Germany illustrates the scam perfectly. Household electricity prices hit €0.41 per kilowatt-hour in 2023, up from €0.32 in 2021, a 28% increase. But Germany's renewable energy share increased during this period, meaning more electricity came from sources with zero fuel costs.

The price increases didn't reflect generation cost increases. They reflected market power and regulatory failure.

The EU's electricity market design, created in the 1990s to promote competition, sets prices based on the marginal cost of the most expensive generator needed to meet demand. If gas-fired plants are the marginal generator, even cheap renewable energy gets sold at gas-equivalent prices.

The system was supposed to incentivize efficient investment. Instead, it became a profit extraction mechanism during crisis conditions.

Energy companies with diversified generation portfolios, renewables, nuclear, gas—made windfall profits by selling cheap-to-produce electricity at crisis prices. A Spanish wind farm producing electricity for €0.03 per kilowatt-hour could sell it for €0.30 when gas prices spiked.

Same electrons, same costs, ten times the revenue.

The European Commission knew about this market design flaw because consumer advocacy groups, independent economists, and even some national governments had been screaming about it since prices started spiking. The Commission's response? A consultation process, some working groups, and vague promises of future reform.

The market design that enabled windfall profits stayed in place throughout the crisis. You paid for their profit margins while Brussels studied the problem.

The Utility Monopoly You Can't Escape

Energy generation is one scam. Energy distribution is another, and this one's even harder to escape because you literally have no choice about who provides your electricity and gas connections.

Europe's utility companies, the ones that own the wires and pipes bringing energy to your home, operate as legal monopolies. You can't switch providers for distribution even if you can switch suppliers for generation.

And these monopolies have spent the past two decades perfecting the art of guaranteed profits through regulatory capture.

The standard model across Europe works like this: utility companies are guaranteed a rate of return on their infrastructure investments, typically 5-8% annually. They submit investment plans to national regulators showing infrastructure needs. Regulators approve the investments and the rate base.

Consumers pay through distribution charges that guarantee the utility's return regardless of actual costs or efficiency.

It's a business model where you cannot lose money unless you're actively trying to. Build infrastructure at inflated costs? Pass it through. Overspend on unnecessary upgrades? Pass it through. Executive compensation doubling? Pass it through.

The regulatory structure guarantees profitability while eliminating any incentive for efficiency or cost control.

Take E.ON, Germany's largest energy company. Between 2019 and 2023, E.ON increased residential distribution charges by 18% while simultaneously paying out €3.2 billion in dividends to shareholders.

The company claimed the price increases were necessary to fund grid modernization and renewable energy integration. Yet dividend payments to shareholders exceeded the capital investment in grid upgrades during the same period.

The mathematics don't work unless you understand the game: charge consumers for infrastructure investments, borrow money at cheap rates (guaranteed by regulatory approval of future revenue), pay executives and shareholders from the spread, and repeat. The infrastructure investment might happen, but it's funded by consumer bills not corporate profits.

Italy's situation is even more absurd. After privatizing municipal utilities in the 1990s and 2000s, Italian cities lost control over pricing while private utility companies gained monopoly positions.

Enel, the former state monopoly turned private corporation, now serves 61 million customers across Europe with guaranteed returns in each market.

When Enel wanted to raise prices in 2022, Italy's regulatory authority ARERA approved increases averaging 55% for electricity and 42% for gas. The justification was rising wholesale costs. But Enel's own financial statements showed net income of €5.6 billion in 2022, up from €3.2 billion in 2021.

Costs went up, sure. But profits went up faster. And Italian consumers had no choice but to pay because Enel owns the distribution infrastructure their homes depend on.

This is the utility monopoly model across Europe: privatize the profits, socialize the costs, eliminate competition, and capture the regulators who theoretically protect consumers. The companies that were supposed to operate more efficiently than state monopolies instead became private monopolies with state-guaranteed returns.

The Grocery Store Inflation Lie

Energy bills are the most visible wealth transfer, but the grocery store might be where you feel it most acutely because you're making choices every week about what you can afford to eat.

European grocery prices increased an average 17% between 2021 and 2023, the sharpest spike since the 1970s. Every major supermarket chain blamed supply chain disruptions, fuel costs, and wholesale price increases.

Everyone nodded sympathetically and absorbed the price increases because what choice did you have?

Then the financial statements came out. And the lie became obvious to anyone willing to look.

Ahold Delhaize, operating Albert Heijn in Netherlands and Delhaize in Belgium, reported net income of €2.5 billion in 2022, up from €1.4 billion in 2020, a 79% increase during the "inflation crisis."

Carrefour, France's largest retailer, posted operating income of €3.3 billion in 2022, up from €2.0 billion in 2020, a 65% increase.

These companies weren't just passing along cost increases. They were expanding profit margins during a period when they claimed to be squeezed by rising costs.

If costs were genuinely pressuring profitability, net income would stay flat or decline even with revenue increases. Instead, profits grew faster than sales, proving margin expansion.

The European Central Bank's own research confirmed what consumer advocates had been saying: corporate profits explained 50-60% of eurozone inflation in 2022-2023, with retailers among the biggest contributors.

Companies used inflationary expectations and supply disruption narratives to raise prices beyond their actual cost increases, betting that consumers would accept the increases without questioning them.

Britain's Competition and Markets Authority investigated grocery price inflation in 2023 and found evidence of coordinated pricing behavior across major supermarkets. When one chain raised prices on staple goods, competitors matched within days.

The CMA couldn't prove explicit collusion, but the pricing patterns showed either illegal coordination or legal oligopoly behavior that produces the same result, higher prices without competitive pressure to moderate them.

The grocery oligopoly is tighter than most people realize. In Netherlands, the top three supermarket chains control 75% of the market. In Germany, four companies control 85%. In France, five companies control 78%.

This concentration gives retailers pricing power that would be impossible in competitive markets.

And when anyone complains, the companies point to their "thin margins" in grocery retail, typically 2-5% net profit margin. But those thin margins apply to revenue in the hundreds of billions, generating massive absolute profits.

Carrefour's 2.5% margin on €86 billion revenue produces more profit than most companies dream of while allowing executives to claim poverty when questioned about prices.

The real margin expansion is hidden anyway. Grocery retailers increasingly operate private label brands with much higher margins than branded products, pushing consumers toward store brands during crisis periods while pocketing the margin difference.

They charge branded suppliers for premium shelf placement and promotions, collecting fees that don't show up in grocery margin calculations. They operate loyalty programs that extract consumer data worth billions for targeted marketing and dynamic pricing.

Your grocery bill went up because corporations could get away with raising it, and the competitive pressure that supposedly moderates prices in free markets doesn't exist when four companies control the entire sector.

The Brussels Subsidy Machine Running in Reverse

Here's where the austerity swindle becomes impossible to ignore: while you're told there's no money for household energy assistance or food subsidies, Brussels is pumping billions into corporate subsidy programs disguised as economic policy.

Germany alone allocated €200 billion for energy relief in 2022-2023. Sounds great until you read the program details. Of that €200 billion, approximately €50 billion went to corporate energy subsidies to maintain "industrial competitiveness."

German industrial giants like BASF, Volkswagen, and Thyssenkrupp received guaranteed energy price caps while residential consumers paid market rates.

The justification was simple: if German industry faces high energy costs, companies will relocate to lower-cost jurisdictions, destroying jobs and tax revenue. The threat of capital flight became justification for subsidizing corporate energy consumption while households paid full freight.

France operated similar programs, providing €20 billion in direct energy subsidies to industrial users while residential electricity prices increased 15%. Spain allocated €16 billion to corporate energy relief. Italy provided €13 billion.

Across the EU, corporate energy subsidies exceeded €100 billion during the 2022-2023 crisis period.

None of this money was conditioned on companies maintaining employment levels, limiting executive compensation, or constraining shareholder payouts. The subsidies were pure transfers with no public benefit requirements.

Many recipients simultaneously announced layoffs, dividend increases, and share buyback programs.

The European Commission's state aid framework theoretically limits these subsidies, requiring competitive bidding and public interest justification. In practice, the Commission approved emergency measures that waived normal restrictions.

The "temporary crisis framework" introduced in March 2022 let member states provide unlimited subsidies to companies affected by energy price increases.

Companies that had just posted record profits qualified for subsidies because they faced higher input costs, never mind that their profits exceeded any cost increases. The state aid rules focus on costs, not profitability, creating absurd situations where profitable companies receive subsidies funded by struggling taxpayers.

Meanwhile, household energy assistance programs ran out of money. Germany's residential energy subsidy program, capped at €3 billion, served only the poorest households and lasted only through winter 2022.

France's energy voucher program provided €100-200 to qualifying households, enough for maybe two weeks of winter heating. Spain's social bond covered partial bills for low-income households but left millions in precarious middle-income situations with no assistance.

The arithmetic is brutal: €100 billion to corporations, €10 billion to households. And you're lectured about fiscal responsibility.

This pattern extends beyond energy. The same institutions demanding household austerity approved €673 billion in state aid to corporations during 2022-2023, making it the highest state aid year in EU history.

The Inflation Story Is Corporate Profit in Disguise

Every news report about inflation tells the same story: supply chains disrupted, labor costs rising, energy prices spiking, central banks raising interest rates to cool demand. All technically true. All missing the point.

Corporate profit margin expansion drove 50-60% of eurozone inflation according to ECB research published in June 2023. Not supply chains. Not wages. Not energy. Corporate profits.

Companies used crisis conditions as cover to raise prices beyond their cost increases, expanding margins to levels unseen in decades.

The ECB study analyzed 2022-2023 inflation and decomposed it into labor costs, non-labor costs, and profit margins. Profit margins contributed 50-60% of inflation in 2022, declining slightly to 40-45% in early 2023.

This wasn't marginal impact. Profit expansion was the dominant inflation driver.

When the ECB then raised interest rates to "fight inflation," those rate increases hit households through mortgage costs and credit card debt while large corporations locked in low-rate financing from the previous decade.

Fighting inflation meant wage suppression and demand destruction for workers while profit margins stayed protected.

Similar analysis from the International Monetary Fund found profit expansion driving 45% of eurozone inflation, with even higher contributions in specific sectors, energy, food retail, consumer goods.

The pattern held across countries: companies with market power used inflation narratives to raise prices faster than costs, betting correctly that consumers would attribute the increases to general inflation rather than corporate pricing decisions.

Britain's Office for National Statistics found corporate margins at their highest levels since records began in 1997. France's statistical agency reported similar findings. Germany's Bundesbank acknowledged profit expansion as an inflation contributor but declined to recommend regulatory intervention.

The silence from competition authorities is damning. If 50-60% of inflation comes from profit expansion in concentrated markets, that's evidence of market failure requiring antitrust intervention.

But European competition enforcement has been captured by the same corporate interests benefiting from the inflation, as documented in previous investigations including Brussels' billion-euro media funding operation that ensures favorable coverage.

You're told inflation is a natural economic phenomenon requiring sacrifice from workers and households. That's a lie. Inflation in this crisis is substantially corporate profit extraction enabled by regulatory failure and market concentration.

The CEO-to-Worker Pay Ratio Nobody Mentions

While you're cutting expenses and skipping purchases, the executives running the companies raising your bills are having their best years ever.

European CEO compensation exploded during the crisis years. The average CEO-to-median-worker pay ratio at major European corporations hit 112:1 in 2022, up from 98:1 in 2020. At energy companies specifically, the ratio reached 174:1.

Shell CEO Wael Sawan received total compensation of £9.7 million in 2023 after the company posted record profits. BP's Bernard Looney received £10 million in 2022 before resigning over undisclosed relationships. TotalEnergies CEO Patrick Pouyanné took home €5.9 million.

These figures include salary, bonuses, and stock awards tied to financial performance, meaning they profited directly from the same price increases crushing consumers.

The pattern extends beyond energy. Volkswagen CEO Oliver Blume received €10.3 million in 2022 while announcing plans to cut 10,000 jobs. LVMH's Bernard Arnault, Europe's richest person, increased his net worth by $53 billion in 2022-2023 while luxury goods prices increased 15-20% and worker wages stagnated.

Grocery retailer CEOs did particularly well. Carrefour's Alexandre Bompard received €6.6 million in 2022, up from €5.8 million in 2020. Ahold Delhaize's Frans Muller took home €7.3 million in 2022, up from €6.1 million in 2020.

These increases came during the period when both companies raised grocery prices dramatically while claiming thin margins.

Executive compensation is theoretically governed by shareholder approval and corporate governance standards. In practice, executive pay committees are staffed by other executives and compensation consultants whose firms depend on maintaining good relationships with management. The approval process is theater.

When consumer advocates and labor unions point out these compensation levels during crisis periods, companies respond with market competition arguments: they need to pay competitively to attract top talent, executive compensation is small relative to overall costs, and performance-based pay aligns management with shareholder interests.

Every argument is bullshit. Executive compensation could be cut 80% without losing talent because the competition for CEO positions exceeds the supply, hundreds of qualified candidates would take these jobs at a fraction of current pay.

Executive compensation is small relative to revenue but massive relative to what wage increases for workers would cost. And performance-based pay aligned with shareholder interests is exactly the problem, it incentivizes profit maximization at consumer and worker expense.

The executive pay explosion during crisis years isn't market economics. It's class warfare where one side has captured the rules.

The Wealth Transfer the Statistics Prove

All of this adds up to the largest upward wealth transfer in modern European history, happening right now, documented in data that governments and corporations hope you're too busy struggling to notice.

Eurostat data shows the wealthiest 20% of Europeans increased their share of total wealth from 62% to 67% between 2020 and 2023. The bottom 40% saw their wealth share decline from 9% to 7%.

This isn't subtle redistribution over decades. This is rapid wealth concentration during a three-year period.

Corporate profits as a share of GDP increased from 34% to 39% across the eurozone during the same period. Labor's share of GDP declined from 56% to 52%. That 4% shift represents approximately €520 billion annually transferred from workers to capital, more than the entire GDP of Belgium.

Household savings rates collapsed from 19% during pandemic lockdowns to 11% by late 2023 as families burned through savings to cover increased living costs. Meanwhile, corporate savings and retained earnings hit record levels.

The savings didn't disappear. They moved from household balance sheets to corporate balance sheets.

The wealth concentration is even more extreme when you examine financial assets. Stock market gains during 2020-2023 primarily benefited the top 10% of households who own 85% of directly held shares.

When central banks bought corporate bonds and provided liquidity support to financial markets, they inflated asset prices that mostly benefited the wealthy while inflation destroyed the purchasing power of wage earners.

Credit Suisse's Global Wealth Report documented that Europe's billionaire wealth increased by $1.5 trillion between 2020 and 2023 while median household wealth stagnated or declined in real terms across most European countries.

The number of European billionaires increased from 628 to 741 during a period characterized by crisis and sacrifice narratives.

This is what austerity for citizens and welfare for corporations produces: rapid wealth concentration, declining living standards for the majority, and record prosperity for those who own capital or control major corporations.

The Politicians Who Made It Happen

The wealth transfer didn't happen by accident or natural market forces. It required specific policy choices by identifiable politicians, many of whom rotated between government positions and corporate board seats.

Ursula von der Leyen, European Commission President, presided over the energy crisis response that protected corporate profits while providing minimal household relief. Before joining the Commission, von der Leyen served on Volkswagen's supervisory board, a position her family connections to the company facilitated.

After leaving that board to avoid conflicts as Commission President, she's publicly suggested she might return to corporate roles after her political career.

Christine Lagarde, European Central Bank President, maintained monetary policy that prioritized inflation control through demand destruction over employment or wage protection. Before the ECB, Lagarde served as IMF Managing Director where she championed austerity policies in Greece, Spain, and Portugal that devastated working-class households.

Her ECB policies follow the same pattern: protect asset values and bank stability, sacrifice workers when necessary.

Olaf Scholz, German Chancellor, approved €50 billion in corporate energy subsidies while limiting household assistance programs. Before becoming Chancellor, Scholz served as Finance Minister during the Wirecard scandal, where his ministry's oversight failures enabled one of Germany's largest corporate frauds.

His crisis management favors corporate interests for documented reasons: the SPD depends on corporate donations and maintains close ties to German industrial giants.

Emmanuel Macron, French President, opposed meaningful windfall taxes on energy companies while raising the retirement age to cut pension costs. Macron's background as Rothschild investment banker shapes his governing philosophy: protect capital, discipline labor, present both as economic necessity.

His government's energy policy protected TotalEnergies' profits while French households faced 15% electricity price increases.

The revolving door between politics and corporate boards is well-documented but bears repeating because it explains policy outcomes: José Manuel Barroso went from European Commission President to Goldman Sachs chairman.

Jean-Claude Juncker, Luxembourg Prime Minister turned Commission President, created the tax haven structure that helps corporations avoid taxes across Europe. Mario Draghi went from Goldman Sachs to European Central Bank to Italian Prime Minister, maintaining pro-corporate policies throughout.

These aren't isolated corruption cases. This is how European governance functions: politicians serve corporate interests, get rewarded with board positions and consulting contracts after leaving office, and the cycle continues.

The policy outcomes, corporate welfare, household austerity, wealth concentration—are features, not bugs. The same pattern appears in how China purchased European Parliament influence through systematic bribery that went unprosecuted.

What This Costs You Specifically

Let's make this concrete with numbers that apply to actual household budgets, because abstract statistics about wealth concentration don't capture what this means for your daily life.

The average European household energy bill increased by approximately €1,200 annually between 2021 and 2023. Of that €1,200, roughly €540 represents corporate profit expansion beyond normal margins, money you paid to energy companies that had nothing to do with their actual cost increases.

Grocery price increases cost the average household approximately €800 annually over the same period. ECB analysis suggests €360-€440 of that represents corporate margin expansion rather than cost pass-through. You paid it because retailers had pricing power and used it.

Transportation costs, fuel, public transit, vehicle maintenance, increased approximately €600 annually for average households. Fuel companies expanded margins during this period by roughly 30%, meaning €180 of your transportation cost increase went to corporate profits not cost increases.

Housing costs for renters increased an average €720 annually across Europe. For homeowners with variable-rate mortgages, interest costs increased €1,400 annually due to ECB rate hikes meant to fight inflation that was substantially driven by corporate profits.

Add it up: €1,200 (energy) + €800 (groceries) + €600 (transportation) + €720-€1,400 (housing) = €3,320-€4,000 in annual cost increases for an average household.

Of that, approximately €1,080-€1,160 represents pure profit extraction, money you paid to corporations that wasn't necessary to cover their cost increases.

That's roughly €90-€100 per month in wealth transfer from your household to corporate shareholders and executives. Multiply by 220 million European households and you get €238-€264 billion in annual wealth extraction.

Now consider what that money could buy: The €238 billion in corporate profit extraction could fully fund residential energy costs for 45 million European households for one year. It could provide €1,000 annual grants to every household in the bottom 40% of the income distribution.

It could eliminate undergraduate tuition at every public university in Europe with €150 billion left over.

But instead, it went to Shell shareholders, Carrefour executives, and utility company dividends. While you cut your heating, skipped purchases, and stressed about bills.

The Competition Law That Doesn't Compete

European competition law theoretically exists to prevent exactly this type of corporate exploitation. The EU Treaties prohibit abuse of market dominance. National competition authorities have powers to break up monopolies and prosecute cartels.

The regulatory framework looks impressive on paper.

In practice, competition enforcement collapsed over the past two decades as neoliberal ideology captured regulatory institutions and corporations learned to game the system.

The European Commission's Directorate-General for Competition approved 94% of merger notifications between 2010-2023 with minimal or no remedies required. When remedies were imposed, they typically involved minor asset sales that didn't address underlying market concentration.

The Commission blocked only 0.6% of notified mergers, a rate suggesting regulation has become rubber-stamping.

Energy market concentration illustrates the enforcement failure. TotalEnergies, Shell, BP, Equinor, and Eni control approximately 70% of European oil and gas refining capacity.

This concentration lets them coordinate pricing without explicit collusion, each company knows competitors will match price increases because everyone benefits from higher prices with inelastic demand.

The Commission could prosecute this as abuse of collective dominance under Article 102 TFEU. It hasn't pursued a major energy sector abuse case in over a decade.

When pressed about energy company profits during the crisis, Competition Commissioner Margrethe Vestager said the Commission was "monitoring" the situation, regulatory speak for doing nothing.

Grocery retail concentration is even worse in specific markets. The Commission approved the merger creating Ahold Delhaize despite the combined company controlling 75% of Netherlands grocery retail. It approved multiple acquisitions that strengthened Carrefour's position in France.

It let Schwarz Group (Lidl/Kaufland) expand across Eastern Europe with minimal scrutiny.

The standard excuse is consumer welfare economics: if prices aren't rising above competitive levels, there's no harm from concentration. But this framework fails during crises when concentrated companies have power to raise prices beyond cost increases.

By the time abuse becomes obvious in price data, the wealth transfer has already occurred.

Britain provides a useful comparison. The UK's Competition and Markets Authority, freed from EU coordination post-Brexit, has been marginally more aggressive. The CMA blocked the Asda-Sainsbury's merger in 2019 specifically due to market concentration concerns.

It's investigating grocery pricing behavior. It forced energy companies to improve customer communications about tariff switching.

These are small steps, but they're more than Brussels has done. The European Commission's competition enforcement has been captured by the corporations it's supposed to regulate, producing toothless investigations and approvals of mergers that concentrate market power.

The ECB Policy That Enriched Asset Owners

The European Central Bank's response to crisis-driven inflation demonstrates whose interests monetary policy serves, and it isn't yours.

When inflation hit 8-10% across the eurozone in 2022, the ECB faced a choice: accept temporary inflation driven by supply shocks and corporate profits, or raise interest rates to crush demand and force workers to accept lower real wages.

The ECB chose demand destruction.

Interest rates increased from -0.5% to 4.5% between July 2022 and September 2023, the fastest tightening cycle in ECB history. The stated goal was reducing inflation to 2% by decreasing demand and moderating wage growth.

The unstated goal was protecting asset values and bank profitability while ensuring workers bore the adjustment costs.

Higher interest rates hit households through multiple channels. Variable-rate mortgages saw monthly payments increase by €200-€400 for average mortgages. Credit card debt became more expensive. Car loans and consumer credit costs jumped.

Saving became marginally more attractive, but real returns stayed negative with inflation exceeding deposit rates.

Corporations, meanwhile, were largely insulated from rate increases because they'd locked in low-rate financing during the previous decade. Major European corporations issued bonds at 0-2% rates between 2015-2021 with 7-10 year maturities, meaning they won't need to refinance at higher rates until 2025-2028.

The rate increases hit households immediately but affected corporations with multi-year lag.

The rate increases also protected banks and asset owners. Higher rates increased bank net interest margins, the spread between deposit rates and lending rates. European banks posted record profits in 2023 as rate increases let them charge more for loans while barely raising deposit rates.

For asset owners, higher rates posed short-term paper losses on bond holdings but protected the fundamental value of capital by crushing wage demands. If workers had won substantial wage increases to offset inflation, real asset values would have declined through erosion of profit margins.

The ECB's policy ensured workers absorbed the inflation through declining real wages rather than capital absorbing it through declining real returns.

ECB President Christine Lagarde explicitly stated this logic in June 2023: "We need to see wage growth moderate to ensure inflation returns to target." Translation: workers must accept declining real wages to protect the 2% inflation target and the asset values that target protects.

The ECB could have chosen alternative approaches. It could have acknowledged that energy and profit-driven inflation wouldn't respond to demand destruction. It could have advocated for windfall taxes, price controls, or competition enforcement.

It could have accepted temporary above-target inflation as preferable to destroying demand and employment.

Instead, it chose the path that protected capital and punished labor, consistent with its institutional bias and the backgrounds of its leadership. Lagarde, like her predecessor Mario Draghi, came from the investment banking world where protecting asset values is the primary objective.

The Corporate Tax Race You're Paying For

While you pay VAT on every purchase and income tax on every euro earned, major corporations pay effective tax rates of 8-15% through strategies enabled by EU tax policy coordination.

Ireland's 12.5% corporate tax rate attracts every major tech and pharma company to establish European headquarters in Dublin. The Netherlands' tax treaty network lets corporations route profits through Dutch holding companies to avoid taxation.

Luxembourg's advanced tax ruling system, built while Jean-Claude Juncker served as Prime Minister before becoming Commission President, enables custom tax deals for major corporations.

These aren't illegal loopholes. They're features of EU tax policy designed to attract corporate investment through tax competition. The cost is borne by workers who pay higher tax rates and receive reduced public services when corporate tax collection collapses.

Total corporate tax revenue across the EU declined from 3.2% of GDP in 2007 to 2.8% in 2023 despite corporate profits increasing as a share of GDP. The tax base grew but collection shrunk because effective tax rates fell faster than profits grew.

Apple's Irish tax structure, eventually ruled illegal state aid by the European Court of Justice, let the company pay effective tax rates below 1% on European profits for over a decade. Apple accumulated $100 billion in undistributed foreign earnings, mostly from European sales, while Ireland's public services operated on austerity budgets.

When the European Commission proposed a minimum effective corporate tax rate of 15% through implementation of the OECD global minimum tax, Ireland, Netherlands, and Luxembourg delayed implementation until forced by international pressure.

Even at 15%, the minimum rate is less than half what workers pay on middle-income wages.

The revenue lost to corporate tax competition is substantial. Estimates from the Tax Justice Network suggest EU member states lose €160-€190 billion annually to corporate tax avoidance schemes enabled by intra-EU tax competition.

That's equivalent to total EU spending on agriculture subsidies and regional development combined.

If corporations paid effective tax rates equal to what middle-income workers pay, roughly 30-35%, European governments would collect an additional €400-€500 billion annually. That money could fund universal energy assistance, eliminate undergraduate tuition, or provide substantial household rebates on cost increases.

Instead, it stays in corporate treasuries and shareholder pockets while you're told there's no money for public services. The tax competition is intentional policy, and the politicians who enabled it knew exactly what they were doing.

The same extraction patterns documented in how the EU systematically loots Africa through trade agreements and resource exploitation now operate domestically against European citizens.

What Comes Next If Nothing Changes

The current trajectory is clear if these mechanisms stay in place: accelerating wealth concentration, declining living standards for the majority, and political instability as populations recognize the system is rigged.

Eurozone wealth inequality is already approaching US levels, previously considered an outlier. The Gini coefficient for wealth distribution increased from 0.68 to 0.72 between 2020-2023, a massive shift in just three years.

For context, anything above 0.70 indicates extreme inequality where a small elite controls the vast majority of wealth.

Household debt is rising as families borrow to maintain consumption levels that wages no longer support. European household debt hit 61% of GDP in 2023, up from 58% in 2020. The debt is financing consumption of basics—food, energy, housing, not discretionary spending.

This debt accumulation is unsustainable. When the next economic shock hits, millions of households will face simultaneous defaults because they have no financial buffers left.

Corporate profit margins can't expand indefinitely without destroying the consumer base those profits depend on. We're approaching the limit where households simply cannot pay higher prices without defaulting on other obligations.

When that breaking point hits, companies will face collapsing demand, but by then they'll have extracted years of excess profits and executive compensation.

Political instability is already visible. Support for establishment parties collapsed across Europe during 2022-2024 elections. Far-right parties gained ground by correctly identifying that the system is rigged, even if their solutions are counterproductive.

Left parties gained less traction because they're compromised by the same corporate funding and institutional capture that affects center parties.

The danger isn't that populations will stay passive. The danger is that justified anger about economic extraction will be channeled toward scapegoats, immigrants, minorities, foreign governments, rather than toward the corporate and political elites actually responsible for the wealth transfer.

This is already happening. Political movements across Europe are blaming immigration for wage stagnation and public service deterioration when the actual cause is corporate profit extraction and tax avoidance.

The misdirection is convenient for elites because it directs popular anger away from them.

If nothing changes, Europe faces a choice between three paths: continued wealth extraction until social breakdown, political authoritarianism to manage the resulting instability, or fundamental restructuring of economic and political power.

The first two paths lead to catastrophe. The third requires confronting corporate power and institutional capture that current political leadership is unwilling to challenge because they're part of the system.

The Choice That's Really No Choice At All

You're told you have choices. Shop around for better energy rates. Find cheaper groceries. Budget better. Work harder. These are the individual solutions presented as responses to systemic wealth extraction.

They're bullshit because they don't address the fundamental problem: you're operating in rigged markets with no real competition, regulated by captured institutions that serve corporate interests, governed by politicians rotating between office and corporate board seats.

You can't shop around for electricity distribution, it's a monopoly. You can't find cheaper groceries when four companies control 80% of the market and coordinate pricing. You can't budget your way out of margin expansion that transfers €100 per month from your household to corporate profits.

The individual choice framework is ideological cover for structural exploitation. It puts the burden of solving systemic problems on individuals who lack the power to change the systems they're trapped in.

The actual choice is political: will European populations demand fundamental restructuring of economic power, or will they accept continued extraction until the system breaks?

That choice requires recognizing that the current arrangement isn't natural or inevitable. It's the result of specific policy decisions made by identifiable people who benefit from those decisions.

Energy markets are designed the way they are because energy companies wrote the regulations. Competition law doesn't enforce competition because corporations captured the enforcement agencies. Corporate tax rates fell because multinational companies demanded tax competition and politicians complied.

None of this happened by accident. All of it can be changed by different political choices.

But those changes require confronting corporate power directly, not through minor reforms or slightly higher taxes that companies can avoid. It requires breaking up monopolies, prosecuting price coordination, imposing excess profit taxes that actually collect revenue, and banning the revolving door between politics and corporate boards.

It requires treating the current crisis not as temporary hardship requiring sacrifice, but as evidence that European capitalism in its current form is a wealth extraction mechanism that needs fundamental restructuring.

The political will for these changes doesn't exist in current European leadership because that leadership is institutionally captured. Real change requires political movements willing to fight corporate power directly, not manage it more nicely.

Until those movements emerge or existing parties are forced to change by popular pressure, the wealth transfer continues. Your bills keep rising. Corporate profits keep breaking records. And you're told it's economics when it's really just theft dressed in technocratic language.

The question isn't whether you'll keep struggling to afford basics while executives get richer. That's guaranteed under current policies. The question is whether you'll keep believing the explanation that this is natural and necessary, or whether you'll recognize it as the organized looting operation it actually is.

A. Kade

"The comfort of the rich depends upon an abundant supply of the poor."

No ads. No sponsors. Just signals from the noise.

Keep The Kade Frequency transmitting.